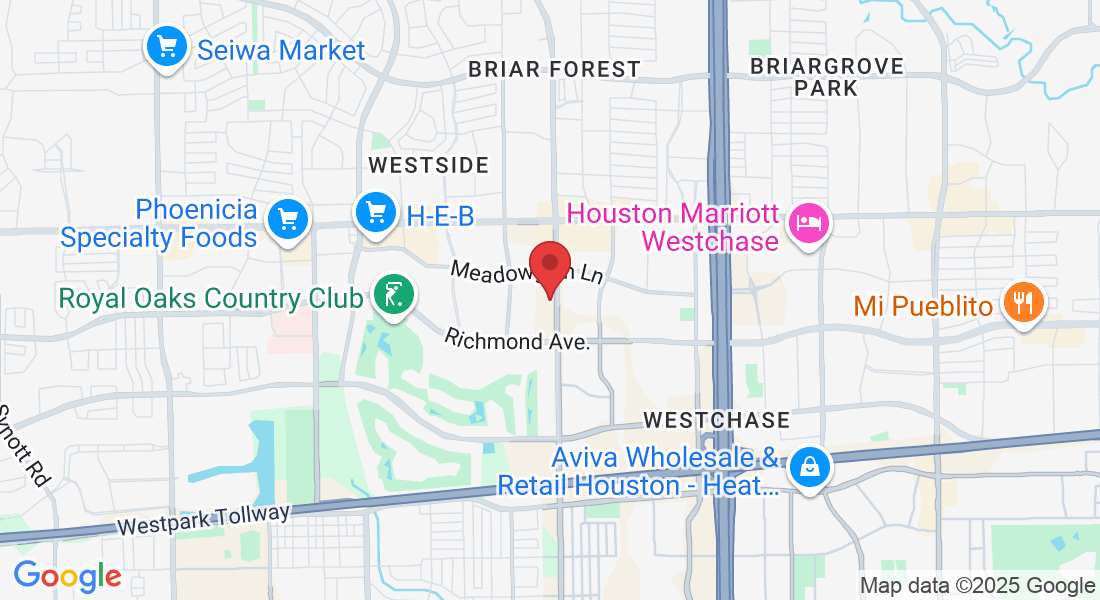

Get in Touch

We're here to help! Whether you have questions about our loan programs, need assistance with your application, or want to learn more about how Wallvestment Capital can support your business, our team is ready to assist you.

Phone:

Call us at (513) 570-4474 to speak directly with a member of our team.

Contact Us

Testimonials

Wallvestment Capital has been a game-changer for our business. As a small restaurant owner, accessing traditional loans was always a challenge. Their short-term loan option provided us with the necessary capital to renovate our space and expand our menu. The process was quick and straightforward, and the team was incredibly supportive throughout. Our revenue has increased significantly, and we couldn't be happier with the results!

— Jamie L., Restaurant Owner

As a single mom, juggling bills and unexpected expenses can be overwhelming. Last month, when I was hit with a higher than normal utility bill, I didn't know how I would make ends meet. Fortunately, the payday lenders provided me with a short-term loan solution that allowed me to keep the lights on until my next paycheck. Their service was confidential, and the process was clearly explained. I can't thank them enough for their assistance during a very difficult time.

— Alex P., Auto Repair Shop Owner

FAQS

What types of businesses do you fund?

We fund a variety of businesses, including restaurants, salons, auto repair shops, medical services, and other professional services. However, we do not provide funding for farmers, adult content, or used car dealerships.

What are the eligibility criteria for your loan programs?

Your business must be operational for at least 6 months. We require at least 4 months of bank statements for evaluation. Loan amounts range from $5,000 to $2,000,000, with interest rates based on risk factors.

How quickly can I receive funding?

Once approved, you can receive funds in as little as 1 to 3 days, provided all necessary information is submitted promptly.

What is Revenue-Based Financing?

Revenue-Based Financing allows you to repay the loan based on a percentage of your monthly revenue. This flexible repayment model aligns with your business's cash flow.

Do you require collateral for loans?

No, our loans are unsecured, meaning you do not need to provide collateral.

What is the approval rate for your loans?

We have an approval rate of up to 80%, making our financing options accessible to many businesses.

How do you assess risk factors?

Risk factors are assessed based on your business's financial health, revenue streams, and industry type, which influence the interest rate offered.

Facebook